In the competitive and fast-paced world of online trading, having the right tools can make a remarkable difference in your ability to read the markets, make informed decisions, and secure profitable trades. Among the most essential resources for any serious trader are advanced charting tools, which provide in-depth visualizations and data interpretations to help forecast potential market movements. When it comes to achieving consistent results, there is no denying that a strong command of technical analysis, combined with the strategic use of CFD Trading tools, is a defining factor for success. These tools give traders the ability to identify trends, pinpoint entry and exit points, and manage their trades with precision, ultimately leading to more calculated and confident decisions in a dynamic market environment.

Understanding the Role of Charting in CFD Trading

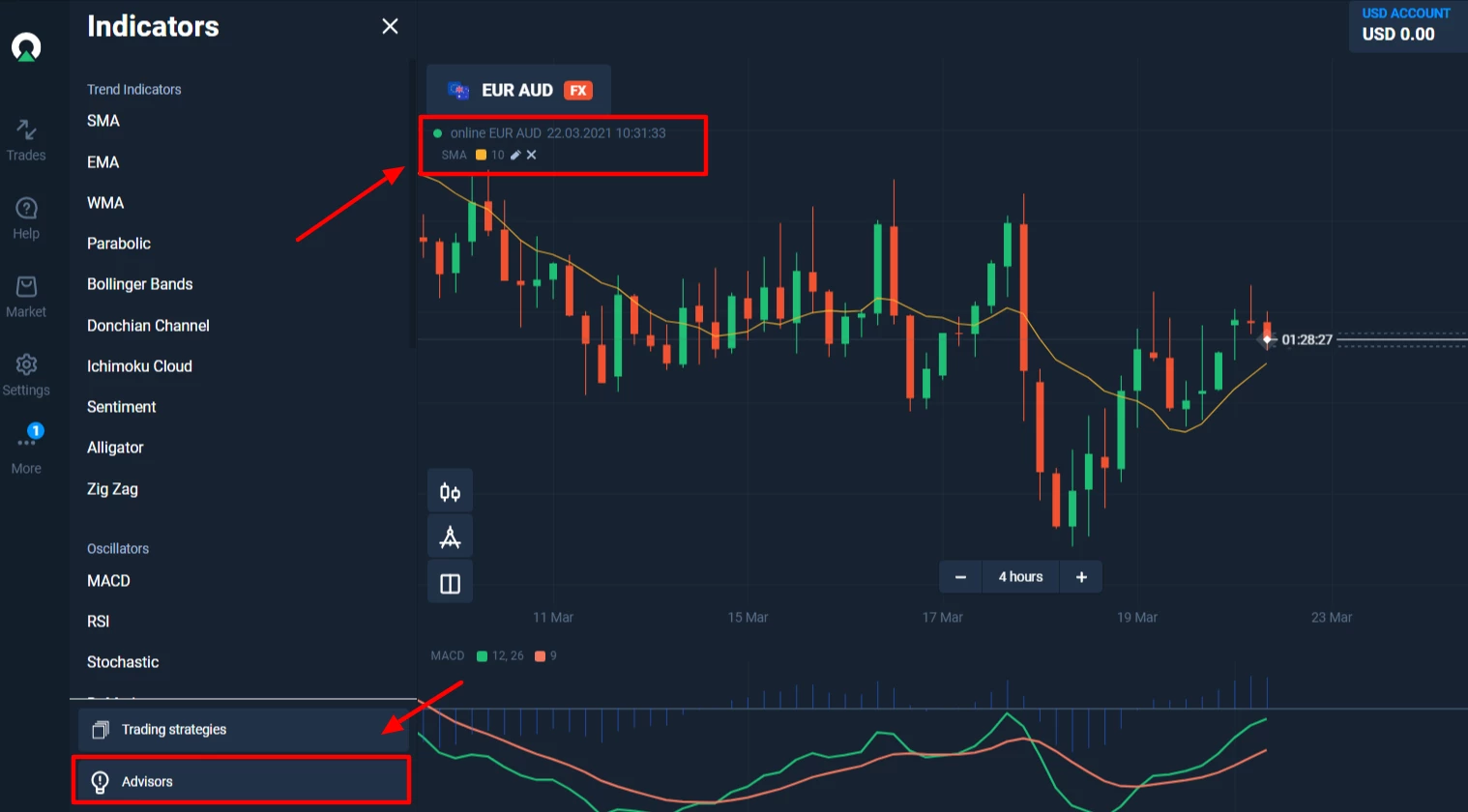

Advanced charting tools are far more than just graphical representations of price movements. They serve as a trader’s real-time window into the markets, providing actionable insights that go beyond what simple price quotes can offer. In CFD Trading, where even small price fluctuations can result in substantial gains or losses due to leverage, charting tools help traders interpret complex data quickly and effectively. Whether you are trading stocks, commodities, indices, or cryptocurrencies through CFDs, understanding the intricacies of technical charts is critical. These tools allow you to apply a variety of indicators such as moving averages, Bollinger Bands, Relative Strength Index (RSI), and Fibonacci retracements, each offering unique perspectives on market behavior and potential opportunities.

Why Advanced Charting Matters in CFD Trading

The key to thriving in CFD Trading lies in your ability to forecast market direction and act decisively. Advanced charting tools empower traders by offering customization options, multi-timeframe analysis, and deep integration with trading platforms. Unlike basic charts, advanced versions allow you to overlay multiple indicators, draw trend lines with precision, and track historical patterns that can repeat under similar market conditions. This level of analysis provides you with the competitive edge needed to differentiate between noise and genuine trade setups, thereby improving your win rate and risk management strategies.

Types of Charting Tools for CFD Traders

In the realm of CFD Trading, there are numerous types of charting tools to choose from, each with its own advantages. Candlestick charts remain one of the most popular choices because they display price action in a visually intuitive manner, highlighting open, close, high, and low prices for each time frame. Line charts offer simplicity, focusing solely on closing prices, while bar charts provide a balanced mix of information. More advanced traders often use Heikin-Ashi charts to filter out market noise or Renko charts to identify trends without the distraction of minor price fluctuations. Pairing these chart types with analytical indicators ensures a comprehensive understanding of the markets.

Essential Technical Indicators for CFD Trading Success

Technical indicators form the backbone of chart-based analysis in CFD Trading. Among the most widely used is the Moving Average (MA), which smooths out price data to identify underlying trends. Exponential Moving Averages (EMAs) give more weight to recent prices, making them responsive to short-term market changes. Bollinger Bands measure market volatility, while the Relative Strength Index (RSI) helps identify overbought or oversold conditions. The Moving Average Convergence Divergence (MACD) indicator provides insights into momentum and potential reversals. When these tools are combined strategically, traders can detect high-probability setups with remarkable accuracy.

Multi-Timeframe Analysis for Better Decision-Making

One of the greatest advantages of advanced charting tools in CFD Trading is the ability to perform multi-timeframe analysis. This approach involves studying the same asset across different time frames, such as the 1-minute, 15-minute, daily, and weekly charts. Doing so enables traders to align short-term opportunities with the broader market trend. For example, a short-term bullish signal on a 15-minute chart may be far more reliable if the daily chart also shows an uptrend. By incorporating multiple time perspectives, traders enhance their ability to make decisions that are both timely and strategically sound.

Drawing Tools and Customization Features

Advanced charting platforms offer robust drawing tools that allow traders to mark support and resistance levels, draw trend lines, and map out chart patterns such as head-and-shoulders or triangles. These annotations act as a visual guide during live trading sessions. In CFD Trading, where speed and clarity are essential, having your charts customized to your trading style can reduce analysis time and improve execution speed. Many platforms also allow you to save templates, ensuring you can quickly switch between asset classes without losing your preferred chart setup.

The Integration of Real-Time Data and Alerts

Access to real-time market data is non-negotiable for successful CFD Trading. Advanced charting tools integrate live price feeds, enabling traders to monitor market changes the moment they happen. Setting price alerts directly on your charts ensures that you are notified instantly when a trading condition is met, whether it’s a breakout above resistance or a dip into a support zone. These alerts help traders react promptly to opportunities, even when they are not actively monitoring the market.

Combining Fundamental and Technical Analysis

While charting tools primarily serve technical traders, combining them with fundamental analysis can significantly enhance results in CFD Trading. By understanding economic indicators, company earnings reports, and geopolitical events alongside your technical setups, you can make more informed decisions. For example, a bullish chart pattern in a stock CFD may align with strong quarterly earnings, strengthening your confidence in the trade. This holistic approach blends the predictive power of charts with the real-world catalysts that drive market movements.

The Role of Automation and AI in Charting

Modern CFD Trading platforms increasingly incorporate automation and artificial intelligence into their charting systems. AI-driven tools can scan multiple markets simultaneously, identify patterns that match your criteria, and even execute trades automatically. Automated strategies based on chart signals eliminate emotional biases and ensure consistent execution, which is critical in maintaining discipline over the long term.

Risk Management Through Charting

Advanced charting tools are not just for spotting opportunities—they are equally important for managing risk in CFD Trading. Features like stop-loss and take-profit levels can be visually plotted on charts, making it easier to assess the risk-to-reward ratio before entering a trade. You can also use volatility indicators to adjust position sizes according to market conditions, helping to protect your portfolio during turbulent times.

Conclusion

The importance of advanced charting tools in CFD Trading cannot be overstated. They provide the precision, flexibility, and analytical depth required to navigate volatile markets successfully. By mastering these tools, traders can enhance their technical skills, improve decision-making, and ultimately increase their chances of consistent profitability. Whether you are a beginner learning to read your first candlestick chart or an experienced trader refining a complex strategy, investing time in chart mastery will pay significant dividends in your trading journey.